Protecting the Future

Real Life Stories: Stephen Miller

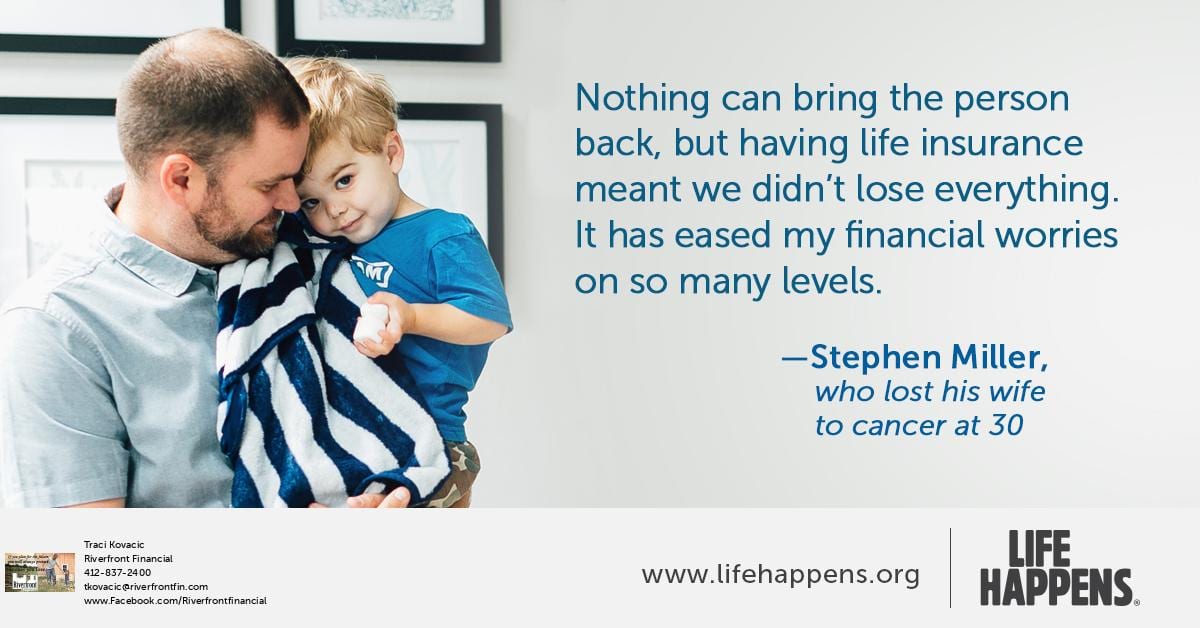

A mutual friend with a new dog brought Stephen and Katie together. Stephen had headed to his friend’s house to meet the new furry member of the family, and when he got there, he saw Katie playing with dog in the backyard. “Katie was so outgoing,” says Stephen. “She was the nicest person you’ll ever meet.”

That first meeting led to beach outings and concerts, and over time to getting married and thinking about starting a family. It was Katie who suggested they get life insurance. Stephen admits he wasn’t too happy about the idea. They were young and healthy, so he didn’t see the point. Katie, however, convinced him to sit down with insurance professional Rose Goheen, who walked them through the process and presented them with affordable options.

They both decided to get life insurance coverage.

A Growing Family

When the couple welcomed Chase, they decided to reevaluate their life insurance. Given their expanding family and responsibilities, they both bought additional life insurance.

It was during her recovery from giving birth to Reid that Katie realized something was wrong. Her doctor confirmed her suspicion that the abdominal lump she felt was something much more serious. In fact, it was an aggressive form of cancer. Katie, with the love and support of her family, valiantly fought the disease, but just over a year later it claimed this young mom’s life.

She was just 30.

No words can capture the devastation that Stephen and his boys felt at Katie’s loss. “It’s horrible to lose your soul mate and best friend,” he says. “But I have two boys to support, and I want them to know their dad can carry on.”

Life insurance has helped with that process.

“Nothing can bring Katie back, but having life insurance meant we didn’t lose everything,” he says. “I don’t earn enough alone to afford living in our house. Life insurance has eased my financial worries on so many levels.”

Thinking back to that first meeting with Rose, Stephen says: “Katie was the smarter one. She knew to plan for the future—our future—with life insurance.”