Life Insurance

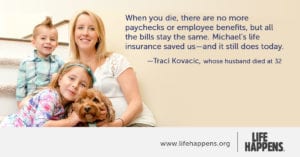

As you grow older, it's important to plan for your family's future financial needs. However, preparing for your passing is not an easy task. The truth is, no one knows what the future holds, and every family is different. That's why at Riverfront Financial, we are able to work with multiple companies to get the right policy for your individual needs. We want to make sure you provide for your family no matter what stage of life you are in.

CONTACT US TODAY FOR YOUR FREE QUOTE!

Ensure your family and beneficiaries live comfortable lives when you pass away by coming to us to help you put the right policies in place.

How much insurance should I have?

How much insurance should I have?

We primarily base this on your income. When you pass away, there are no severance checks or benefits that remain for your family. Depending on what stage of life you are in, and how many people rely on your income, we would recommend the right protection for your loved ones. Remember-stay at home parents need coverage too! You can use our Life Insurance calculator here to find out more about how much coverage you should have!

How much does it cost?

Your premium is based on your sex, age and health history.

Click HERE to find the premium for your age & health!

For Example: A healthy 30 year old man could get $500,000 of coverage for 20 years for less than $20/month

Click here to contact us for a free quote!

I already  have insurance, why should I review it?

have insurance, why should I review it?

Insurance today is much different than it was just five years ago! Many companies now offer living benefits, which allows you to use a portion of the death benefit for qualified medical expenses.

Contact us today to schedule your a free review of your families life insurance policies!