Posts tagged with "Life Insurance"

Real Life Stories: Protecting the Future

Protecting the Future

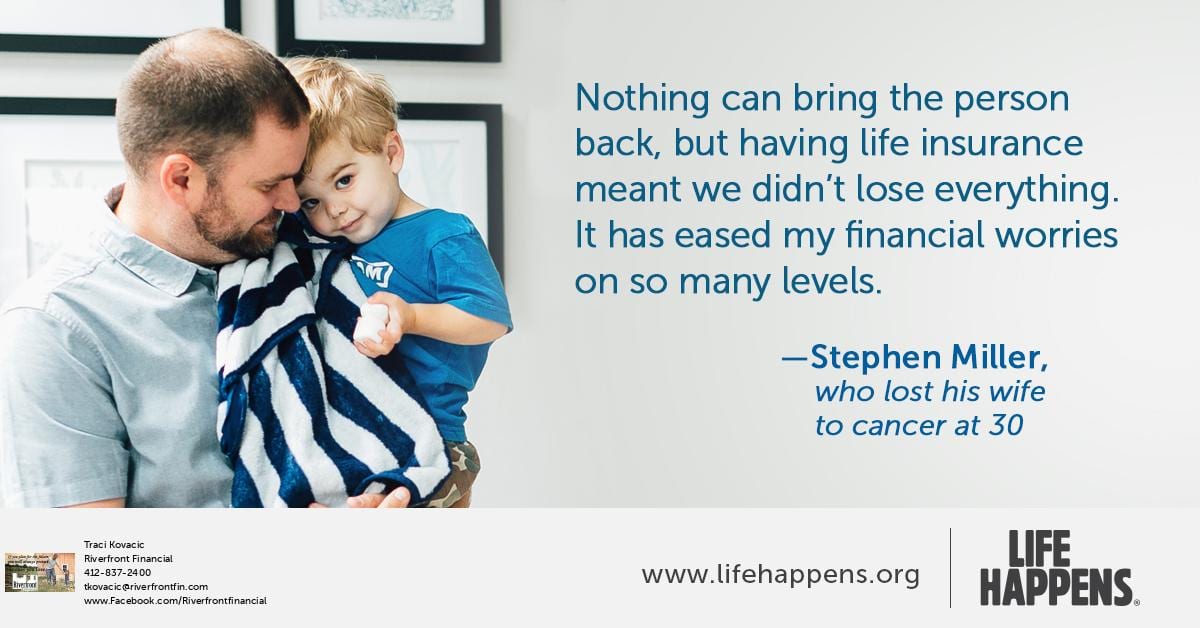

Real Life Stories: Stephen Miller

A mutual friend with a new dog brought Stephen and Katie together. Stephen had headed to his friend’s house to meet the new furry member of the family, and when he got there, he saw Katie playing with dog in the backyard. “Katie was so outgoing,” says Stephen. “She was the nicest person you’ll ever meet.”

That first meeting led to beach outings and concerts, and over time to getting married and thinking about starting a family. It was Katie who suggested they get life insurance. Stephen admits he wasn’t too happy about the idea. They were young and healthy, so he didn’t see the point. Katie, however, convinced him to sit down with insurance professional Rose Goheen, who walked them through the process and presented them with affordable options.

They both decided to get life insurance coverage.

A Growing Family

When the couple welcomed Chase, they decided to reevaluate their life insurance. Given their expanding family and responsibilities, they both bought additional life insurance.

It was during her recovery from giving birth to Reid that Katie realized something was wrong. Her doctor confirmed her suspicion that the abdominal lump she felt was something much more serious. In fact, it was an aggressive form of cancer. Katie, with the love and support of her family, valiantly fought the disease, but just over a year later it claimed this young mom’s life.

She was just 30.

No words can capture the devastation that Stephen and his boys felt at Katie’s loss. “It’s horrible to lose your soul mate and best friend,” he says. “But I have two boys to support, and I want them to know their dad can carry on.”

Life insurance has helped with that process.

“Nothing can bring Katie back, but having life insurance meant we didn’t lose everything,” he says. “I don’t earn enough alone to afford living in our house. Life insurance has eased my financial worries on so many levels.”

Thinking back to that first meeting with Rose, Stephen says: “Katie was the smarter one. She knew to plan for the future—our future—with life insurance.”

Annual Financial To-Do List

Annual Financial To-Do List

Things you can do for your future as the year unfolds.

What financial, business, or life priorities do you need to address for the coming year? Now is an excellent time to think about the investing, saving, or budgeting methods you could employ toward specific objectives, from building your retirement fund to managing your taxes. You have plenty of choices. Here are a few ideas to consider:

Can you contribute more to your retirement plans this year? In 2021, the contribution limit for a Roth or traditional individual retirement account (IRA) is expected to remain at $6,000 ($7,000 for those making “catch-up” contributions). Your modified adjusted gross income (MAGI) may affect how much you can put into a Roth IRA. With a traditional IRA, you can contribute if you (or your spouse if filing jointly) have taxable compensation, but income limits are one factor in determining whether the contribution is tax-deductible.1

Remember, withdrawals from traditional IRAs are taxed as ordinary income, and if taken before age 59½, may be subject to a 10% federal income tax penalty starting again in 2021. Roth IRA distributions must meet a five-year holding requirement and occur after age 59½ to qualify for tax-exempt and penalty-free withdrawal. Tax-free and penalty-free withdrawals from Roth IRAs can also be taken under certain other circumstances, such as a result of the owner’s death.2

Keep in mind, this article is for informational purposes only, and not a replacement for real-life advice. Also, tax rules are constantly changing, and there is no guarantee that the tax landscape will remain the same in years ahead.

Make a charitable gift. You can claim the deduction on your tax return, provided you follow the Internal Review Service (I.R.S.) guidelines and itemize your deductions with Schedule A. The paper trail is important here. If you give cash, you should consider documenting it. Some contributions can be demonstrated by a bank record, payroll deduction record, credit card statement, or written communication from the charity with the date and amount. Incidentally, the I.R.S. does not equate a pledge with a donation. If you pledge $2,000 to a charity this year but only end up gifting $500, you can only deduct $500.3

These are hypothetical examples and are not a replacement for real-life advice. Make certain to consult your tax, legal, or accounting professional before modifying your record-keeping approach or your strategy for making charitable gifts.

See if you can take a home office deduction for your small business. If you are a small-business owner, you may want to investigate this. You may be able to write off expenses linked to the portion of your home used to conduct your business. Using your home office as a business expense involves a complex set of tax rules and regulations. Before moving forward, consider working with a professional who is familiar with home-based businesses.4

Open an HSA. A Health Savings Account (HSA) works a bit like your workplace retirement account. There are also some HSA rules and limitations to consider. You are limited to a $3,600 contribution for 2021 if you are single; $7,200 if you have a spouse or family. Those limits jump by a $1,000 “catch-up” limit for each person in the household over age 55.5

If you spend your HSA funds for non-medical expenses before age 65, you may be required to pay ordinary income tax as well as a 20% penalty. After age 65, you may be required to pay ordinary income taxes on HSA funds used for nonmedical expenses. HSA contributions are exempt from federal income tax; however, they are not exempt from state taxes in certain states.

Pay attention to asset location. Tax-efficient asset location is one factor that can be considered when creating an investment strategy.

Review your withholding status. Should it be adjusted due to any of the following factors?

* You tend to pay the federal or state government at the end of each year.

* You tend to get a federal tax refund each year.

* You recently married or divorced.

* You have a new job, and your earnings have been adjusted.

These are general guidelines and are not a replacement for real-life advice. Make certain to consult your tax, human resources, or accounting professional before modifying your withholding status.

Did you get married in 2020? If so, it may be an excellent time to consider reviewing the beneficiaries of your retirement accounts and other assets. The same goes for your insurance coverage. If you are preparing to have a new last name in 2021, you may want to get a new Social Security card. Additionally, retirement accounts may need to be revised or adjusted?

Are you coming home from active duty? If so, go ahead and check on the status of your credit and any tax and legal proceedings that might have been preempted by your orders.

Consider the tax impact of any upcoming transactions. Are you planning to sell any real estate this year? Are you starting a business? Might any commissions or bonuses come your way in 2021? Do you anticipate selling an investment that is held outside of a tax-deferred account?

If you are retired and in your seventies, remember your RMDs. In other words, Required Minimum Distributions (RMDs) from retirement accounts. Under the SECURE ACT, in most circumstances, once you reach age 72, you must begin taking RMDs from most types of these accounts.6

Vow to focus on your overall health and practice sound financial habits in 2021. And don’t be afraid to ask for help from professionals who understand your individual situation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment.

Riverfront Financial and The O.N. Equity Sales Company are unaffiliated companies

Citations

-

thefinancebuff.com, August 12, 2020

-

usnews.com, February 12, 2020

-

irs.gov, April 3, 2020

-

nerdwallet.com, July 31, 2020

-

msn.com, August 19, 2020

6. thestreet.com, December 21, 2019

Budgeting for Beginners

Budgeting for Beginners

Getting started with your household budget.

Budgeting towards needs and goals. One of the objectives of creating a household budget is that, as time moves on and the various household members advance in their careers, they are likely to make more money. Knowing where that money goes can help direct that money to not only meet your day-to-day needs but also to potentially realize your financial goals. Rent payments may become mortgage payments, and socking away a few bucks into your savings each payday could change into an effective financial strategy involving various investment tools.1

Remember that investing involves risk, and the return and principal value of investments will fluctuate as market conditions change. Investment opportunities should take into consideration your goals, time horizon, and risk tolerance. When sold, investments may be worth more or less than their original cost. Past performance does not guarantee future results.

The back of an envelope or a spreadsheet app. Traditionally, a household budget could be worked out “on the back of an envelope.” Of course, this is still true, though you may have access to more bells and whistles than previous generations. Whether you prefer to work it out with pencil and paper or by computer, the main rule is to create and stick to the budget.

Easy come, easy go. Start by taking note of your income. Some Americans have more than one income source, either through a second gig or even a hobby turned small business. You don’t have to be making money very long, though, to realize that it doesn’t always sit still in your checking account. Along with your income, tally up your expenditures: Housing costs (rent, utilities, etc.), groceries, student loan payments, transportation expenses, phone, and Internet, as well as entertainment. It adds up! (More like subtracts, actually.)

Make adjustments. Ideally, the number at the bottom of this reckoning should be a positive number. This means that you’re living within your means and, while you may want to make that a larger number by adjusting your expenses, you’re at a good starting point.

Adjustments are probably overdue if you have a negative number; you’ll need to take a cold hard look at those expenses and think about can I live without (such as mountaineering lessons) and what isn’t going to give (the essentials: food and shelter).

Your other choice, of course, is to make more money. As you move on in your career, this will likely happen as you earn salary increases or build your business. Don’t forget, though, that life gets more expensive over time, as well. Rents and fees will rise as time goes on. Regular adjustments are a natural part of good budgetary maintenance.

Goals and strategies. If you have money coming in that is not being gobbled up by line items on your budget, and you stick to it and keep it that way, you’re (literally) coming out ahead. Now’s the time to put that money to work toward goals and strategies. Goals can be small, like saving up for a vacation or upgrading an item in your home. Or they can be larger, like saving for a major expense.

Goals can work side-by-side with financial strategies, which tend to be “bigger picture” in scope. Financial strategies tend to be things like looking ahead to your retirement or investing in creating more income (so you can get back to mountain climbing). For these bigger strategies and the shorter-term goals, there is an advantage to seeking out a financial professional geared toward helping you get the most from your efforts.

There is no “one way” to budget. There isn’t a single, one-size-fits-all solution for creating and maintaining a household budget. Financial professionals also know this and can help craft a strategy suited to your risk tolerance, goals, and financial situation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment.

_________________________________________________________________________________

Traci L. Kovacic is a registered representative of and offers securities through The O.N. Equity Sales Company, Member FINRA/SIPC, One Financial Way; Cincinnati, OH 45242; (513)794-6794

Riverfront Financial and The O.N. Equity Sales Company are unaffiliated companies

Citations.

-

PewResearch.org, March 25, 2020

Living Benefits in a Life Insurance policy

What are Living Benefits in a Life Insurance policy?

Quite simply, living benefits are benefits that allow you to access a portion of your policies death benefit while you are still living, if you are diagnosed with a qualifying illness.

In fact, many life insurance policies come with living benefits. The money received can be used any way you choose, from paying hospital bills, to making up for missed work due to illness, and more.

Death may not be the only risk you face on a daily basis. Being diagnosed with a serious illness can also have an adverse effect on your family’s finances, from the high cost of medical bills, to missed work, home nursing care, and much more. Often times, it’s very difficult for families to afford these kinds of expenses with their current income, making a difficult situation even more difficult. That’s where living benefits have advantages.

You may know that life insurance can help fill the income gap for your family and/or beneficiaries if you were to die unexpectedly. Life insurance policies with living benefits add an extra layer of protection if other needs should arise.

To see how life insurance with living benefits can add further protection to your family’s financial strategy and help guard against the unexpected and unknown. Contact us today to learn more about the importance of Life Insurance’s living benefits.

September is Life Insurance Awareness Month!

It’s time for your life insurance check-up.

September is National Life Insurance Awareness Month, so it’s a great time to review your coverage.

If you don’t have any life insurance, you’re not alone. Life insurance is one of those “someday” things for many people – but the cheapest time to buy it is probably today.

There are two kinds of life insurance: term and permanent. Additionally, there are three kinds of permanent life insurance: whole, universal, and variable.

How do these forms of life insurance differ, and how do you find out which type of coverage is right for you?

The way to find out is to look at where you are in life, so that you can assess your current insurance needs. Have you reviewed your insurance lately? Don’t think you need life insurance? If so, consider the following potential factors that may make it a good idea:

*You have a spouse or partner

*You have children

*You have an aging parent or disabled relative who depends on you for support

*Your household depends heavily on your income

*Your retirement savings or pension won’t be enough for your spouse or partner to live on should you pass away

*You own a business, either solely or with partners

*You have a substantial joint financial obligation, such as a personal loan for which another person could be legally responsible after your death

In any of these circumstances, you may require life insurance. If you have coverage, changes in your life may demand an update.

The affordability of life insurance may surprise you. Many people think it is expensive, and so often, it is not. The non-profit insurance education group Life Happens recently

conducted a study about this. More than half the millennial’s contacted for the study thought a $250,000 term life policy would cost $1,000 or more per year. The reality: the a

average annual premium is about $160.1

Life insurance is intended to help your loved ones financially after you die.

The proceeds from a life insurance policy may help your spouse, partner, or family members manage finances if they have to adjust to life without your income.

The death benefit may also be used to meet funeral costs and other final expenses, which may run into the tens of thousands of dollars.

Are you still unsure about buying life insurance, or do you suspect that your current insurance coverage needs to be updated?

Please contact us at (412) 837-2400 or Tkovacic@Riverfrontfin.com and we will be happy to assist you in evaluating all the factors and help you choose an appropriate policy.

This material was prepared by MarketingPro, Inc for use by Traci Kovacic

Traci L. Kovacic is a registered representative of and offers securities through The O.N. Equity Sales Company, Member FINRA/SIPC, One Financial Way; Cincinnati, OH 45242; (513)794-6794

Riverfront Financial and The O.N. Equity Sales Company are unaffiliated companies

Citations.

1 – forbes.com/advisor/insurance/how-much-life-insurance-do-you-really-need/ [8/7/19]